Q4 Manhattan Market Report

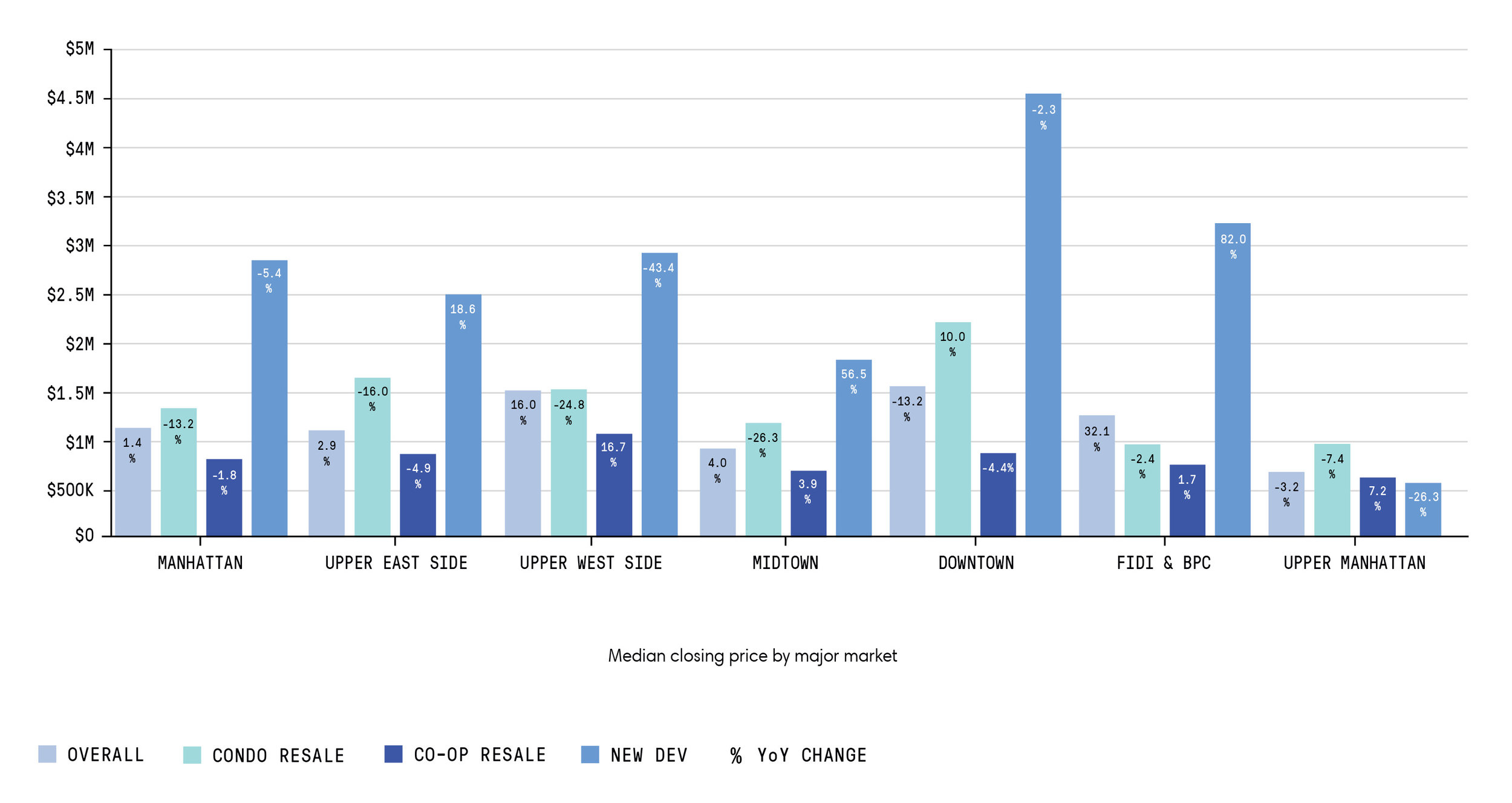

The Q4 2017 Manhattan Market Report from Compass is out today. Among other topics, the report addresses growing concerns of the implications of the 2017 Tax Bill. In anticipation of sweeping changes to tax legislation, resale activity ramped up during the fourth quarter as buyers rushed to lock-in the full $1M mortgage interest deduction on new mortgage originations. Resale closings for condos and co-ops within the $1M - $3M price segment, where buyers could be most impacted by the new limit in mortgage interest deductions, increased 11% and 13% year-over-year, respectively. Furthermore, resale activity within the $500K - $1M price segment increased 21% year-over-year as potential buyers originally feared a mortgage interest cap of $500K. In fact, median condo resale prices were down 13% this quarter compared to 4Q16, which was not attributable to any particular project or neighborhood, but as a result of a broader shift in resale volume to units priced between $500K - $1M. However, it remains to be seen how the GOP Tax Bill will impact Manhattan real estate performance long-term, especially when taking into account the $10K cap to state and local income taxes (SALT) deductions, lower marginal taxes for many income brackets, and the new $750K limit in mortgage interest deductions.

To read the full report, click here!